What's the Right Payer Mix for Your Practice?

Here’s what WebPT learned from its most recent rehab therapy industry survey. Click here to learn the right payer mix for your clinic, here.

Subscribe

Get the latest news and tips directly in your inbox by subscribing to our monthly newsletter

Insurance payments for healthcare services have been declining for a while now, which means providers in all disciplines are looking for ways to optimize their payer mix to maximize their revenue. If you haven’t yet calculated the cost of providing your services—and compared that number to the payments you’re receiving to ensure you’re actually making enough money to not only cover those costs but also turn a profit—then you should. But the question remains: should practices go full-tilt cash-based, remain loyal to commercial and/or government payers, or accept a combination of all three? Here’s what WebPT learned from the 2018 rehab therapy industry survey (you can download the full survey report here) about the payer mix in therapy as well as some factors to consider when making your own payer mix decision:

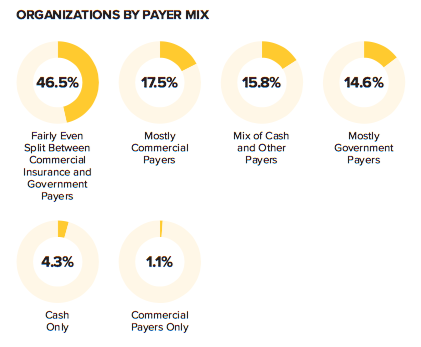

Most organizations have a fairly even split in payer mix between commercial and government payers.

As you can see below, the majority of organizations surveyed operate on a fairly even split between commercial insurance and government payers. A much smaller percentage of providers accept mostly commercial payers, a mix of cash and other payers, or mostly government payers. And few accept only cash or only commercial payers. In other words, most practices still rely heavily on third-party payers.

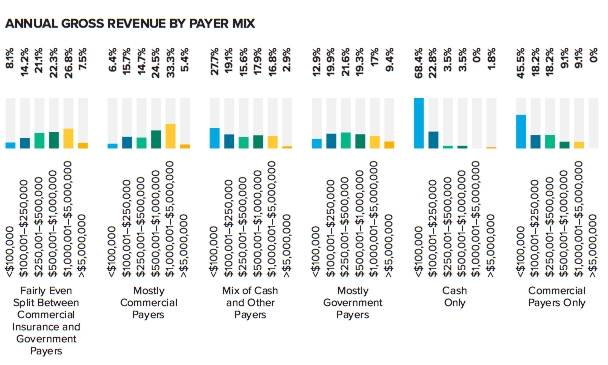

There’s also a fairly even distribution of payer mixes across revenue segments—with two exceptions.

Now, as the report shows, when it comes to annual gross revenue, “there’s a fairly even distribution of payer mixes across all revenue segments”—until you get to the cash-only and commercial payer-only segments, which are “dominated by providers with a gross annual revenue of less than $100,000.”

There’s also a fairly even distribution of payer mixes across revenue segments—with two exceptions.

Now, as the report shows, when it comes to annual gross revenue, “there’s a fairly even distribution of payer mixes across all revenue segments”—until you get to the cash-only and commercial payer-only segments, which are “dominated by providers with a gross annual revenue of less than $100,000.”

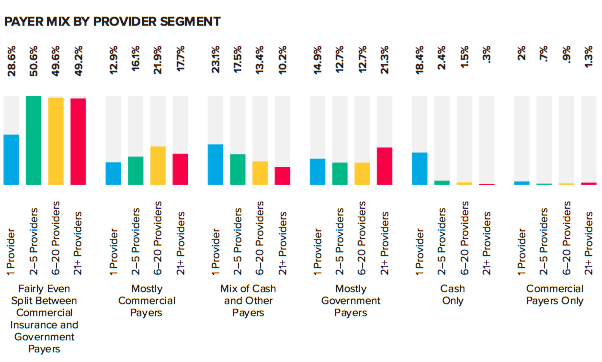

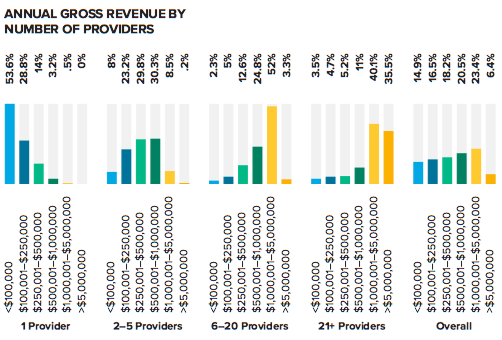

Cash-based organizations are often run by single providers.

We’re not sure why this distribution exists in the commercial-payers-only segment—perhaps it’s simply due to this segment’s small sample size—but it does make sense in the cash-only group, because (as you’ll see in the graphs below), “cash-based entities account for 18.4% of single-provider organizations but do not represent more than 2.4% of any other provider segment.”

In other words, many cash-only practices are run by single providers—more than half of whom make less than $100,000 in annual gross revenue.

There’s no one-size-fits-all payer mix.

As you can see, there is not one “right” answer as to the best payer mix for a given practice, but there are some interesting trends. For example, it appears that compared to single-provider practices, larger practices are more likely to accept an even split between commercial third-party payers and government payers (e.g., Medicare and Medicaid). However, that is still the most popular payer mix type for practices of all sizes—although it’s not totally clear whether that arrangement is popular because that’s the way it’s always been done, or because it actually generates the most revenue. Single-provider practices were also more likely to operate using a hybrid payer model—that is, a mix of cash and other payers—than any other provider group surveyed. It will be interesting to see how these numbers change over the next few years as cash-based practice models become more popular—and hybrid models even more so. After all, it’s becoming increasingly difficult to rely exclusively on third-party payer reimbursements.

But, there are several factors to consider when making payer decisions.

As I discussed in this blog post, before deciding on a payer mix, providers should consider several factors, including how much risk they’re willing take as well as their geographic area, referral sources, and overhead costs—not to mention patient demographics. After all, some patients simply may not be comfortable paying for your services out of pocket, even if they receive reimbursement from their insurance company. And some referral sources may only be willing to pass on patients with a particular insurance.

Staying in-network with every payer may not be sustainable.

That being said, keeping an in-network relationship with every payer may not be a sustainable practice—especially if you’re not earning enough money to cover the cost of a patient visit. After all, going out-of-network enables you to negotiate with the patient directly to establish a price point that works for both of you. That’s not an option you have available when you’re under contract with a payer. According to WebPT President Heidi Jannenga in this webinar, “some providers try to make up the cost difference [of a low-ball third-party payer rate] by either increasing the volume of patients they see or reducing total patient treatment time or care episodes, but none of those decisions are based on what’s best for patients; instead, those providers are making concessions to their treatment plans that essentially reduce the quality of the care they’re providing for all of their patients.” And that’s a slippery slope that could end up hurting your patients—and your practice’s reputation.

But, there are situations in which you may want to remain in-network—even if the fee schedule is less than ideal.

Every decision to drop a payer should be made with caution because it could cause a drop in revenue—at least in the short term. While hanging on to a payer that requires you to cut corners on patient care is an all-around bad idea, former WebPT CEO Nancy Ham believes there are some situations in which you may want to remain in-network with a particular payer, even if the fee schedule isn’t ideal—for example, when dropping that payer could:

- “prevent some of your current patients from receiving the care they need,

- “reduce the number of new patients you see, and

- “cause problems with your top referrers.”

While optimizing your payer mix is crucial to the success of your practice, there are several other things you can do to boost revenue and ensure operational efficiency—thus improving your bottom line. For example, you could focus your energy on improving patient retention and implementing lean business principles. That way, if you need to keep a payer on for any one of the reasons Ham mentioned, you’ll still be in good financial shape.

The conversation around the payer mix in your practice can be a complicated one: how do you balance greater access for patients with what’s best for your bottom line? The correct answer—having private health insurance, Medicare, and Medicaid properly value rehab therapy services—doesn’t seem to be forthcoming, so until then, you have to make the best decisions you can to improve your payer mix. After all, if you don’t look out for your financial health, you won’t be able to care for your patients’ physical health.